"19. At all times relevant to this Complaint, defendants have engaged in the

advertising, promotion, offering for sale, sale, or distribution of telemarketing and professional

fund-raising goods and services to not-for-profit police, firefighter, and other organizations

(hereinafter, “charity” or “charities”) in various states and Canada.

20. Starting in or about 2004, defendants began changing their contracts with the

charities to identify CDG as the charities’ “professional management consultant” (“PMC”)

instead of the charities’ professional fund-raiser.

21. Defendants created the PMC arrangement to evade the Order and the Rule.

Defendants attempted to create the impression that the charities staff and run the fund-raising

campaigns without the involvement of any professional fund-raiser or middleman in order to

suggest that the charities receive a relatively large share of contributions. In reality, however,

CDG, not the charities, directs the solicitors, runs the campaigns, and the charities receive a

small percentage of the donations for their own use.

22. The PMC contract, as well as scripts used by telephone solicitors, indicate:

A. that the telephone solicitors contacting prospective donors on behalf of the

charities work for the charities;

B. that the charities run their own fund-raising campaign; and

C. that donations are paid directly to the charity.

23. Specifically, pursuant to the PMC arrangement, defendants provide scripts used

by the telephone solicitors that state in substance or verbatim:

A. “[Prospect’s name], this is [solicitor’s name]. I work directly for

[charity].... I’m going to be sending a decal out to [person’s address].

Please display this proudly to show your support of [charity]. Now

[charity] does need your support, and donation levels are gold at $45 and

silver at $25. Which one is best for you?”

B. If the person asks, “What company do you work for?” or “What fund-

raising company are you calling from?” the script prompts, “Sir/Ma’am, I

work directly for [charity]. I am an [charity] employee calling you from

the fund-raising center in [place]. I do not work for a fund-raising

company.”

C. If the person persists, the script prompts, “Sir/Ma’am, I do not think you

understand, the [charity] IS the fund-raiser. I am NOT an employee of a

third party telemarketing company. The [charity] operates its own call

center and I am employed directly by them, so they don’t need to hire a

professional fund-raising company.” (Emphasis in original.)

D. If persons ask, “How much of my donation goes to [charity]?” the script

says, “100% goes directly to [charity]. I am an employee of [charity] and

not an outside fund-raising company. The [charity] now runs an in-house

fund-raising drive from the [charity’s] office. Of course, there are costs

associated with the drive and the [charity] programs, but they are all paid

directly by [charity].”

E. If persons ask, “How much does the organization receive?” the script

prompts, “100% of the funds collected will go to [charity], a portion of

which will be used to pay the cost of the fund drive.”

F. If persons ask, “Why Doesn’t your number display on my caller ID?” the

script prompts, “The Telephone Sales Rule exempts nonprofits and

political calls from the new caller-id requirements.”

24. Pursuant to the PMC arrangement, however, defendants continue to recruit, hire,

train, manage, and discipline the telephone solicitors.

25. In addition defendants:

A. prepare payroll and payroll reports;

B. provide and maintain insurance for the charity against the acts or

omissions of the call center personnel;

D. arrange for the charity to designate a charity employee as “Director of Fund-raising;” andE. sub-let the call center to the charity.

26. Under the PMC arrangement, defendants also run the fund-raising campaign for

the charities.

27. Specifically defendants:

A. prepare scripts used to solicit donations, brochures, and fund-raising

correspondence;

B. print and mail response pieces and “supporter” decals;

C. analyze and provide reports on the progress of the campaign and on the

performance of individual solicitors;

D. deposit federal and state withholding and FICA for telephone solicitors

and prepare W-2's and tax returns;

E. acquire and maintain phone service for the telephone solicitations;

F. provide computer, recording and other equipment, and provide technical

support to maintain such equipment;

G. obtain and maintain furniture, supplies, and facilities for use at the

telephone call centers;

H. collect, manage, and account for charitable donations;

J. provide and maintain Broad Form Commercial Liability Insurance for the

fund-raising activities;

K. monitor the charity’s compliance with state and local laws relating to fund-

raising and assure the appropriate government forms and applications are

filed timely

L. supply and manage lead lists; and

M. provide capitalization to seed fund-raising campaigns until they begin

generating a sustaining cash flow.

28. The PMC contract provides that donations be sent directly to the charities, using

language such as the following:

All proceeds...shall be deposited in a bank account under the sole and exclusive

control of [charity] (hereinafter referred to as the ‘Depository Account’). The

proceeds shall be directed to a financial institution for processing. [Charity] has

selected Financial Processing Services to provide this function.

29. The PMC charities select Financial Processing Services (“FPS”) to process

donations.

30. FPS is headed by Dolores Keezer.

31. Dolores Keezer is defendant Keezer’s mother.

32. Telephone solicitors direct donors to send their contributions to commercial

mailboxes opened in the names of the charities.

33. Dolores Keezer establishes these commercial mailboxes.

34. When donations are received, the commercial mailbox providers forward them to

Dolores Keezer.

35. Dolores Keezer, acting through FPS, deposits the donations in separate

commercial bank accounts established in the name of each charity.

36. The contracts between the charities and FPS authorize FPS to distribute the

money in these accounts in accordance with the terms of the charities’ contracts with CDG.

37. FPS controls and directs the withdrawals from these bank accounts.

38. The charities do not direct withdrawals from these bank accounts.

39. FPS uses the money in these accounts to pay the costs of the fund-raising

campaigns and CDG’s profits.

40. FPS pays the remainder, which on average is no more than 15% of the donations,

to each charity.

41. In numerous instances, the telephone calls soliciting donations for the charities

fail to transmit the telemarketer’s telephone number, or the charity’s name and customer or donor service telephone number to the prospective donor’s caller identification service.

42. In addition, in numerous instances, the telephone calls soliciting donations for the

charities are made to persons who previously stated that they did not wish to receive calls made on behalf of the charity."

- https://www.ftc.gov/sites/default/files/documents/cases/2007/09/070921cmpc3810.pdf

- https://www.ftc.gov/sites/default/files/documents/cases/2007/09/070921cmpc3810.pdf

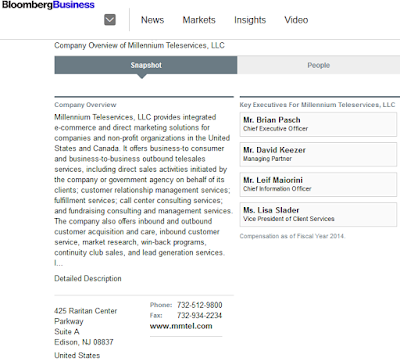

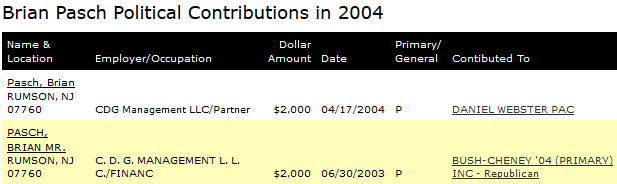

The FTC states that on or about 2004 CDG began engaging in the alleged business practice. CDG had came up with a "work around way" to continue their telemarketing fundraising operations. Again, during the time frame when Brian was reporting his position as "Partner".

Some of the charities that CDG "raised" money for include, and this is just a small sample:

CA State Firefighters Association

Fraternal Order of Police

Cancer Fund of America

Cancer Survivors Fund

Professional Peace Officers Charity

California Organization of Police and Sheriffs (COPS)*

*In 2011, a Consent Judgement was entered in a CA state lawsuit against COPS, CDG, and FPS in regards to their illegal "work around" arraignment the FTC referred to above. The time frame California stated the violations occured was 2004-2008. CDG was fined $1M in combined civil penalty / restitution. FPS was fined $100K in combined civil penalty / restitution.

http://oag.ca.gov/sites/all/files/agweb/pdfs/charities/operation/CA.Police.Org.ConsentJudgment.pdf?

Although, the total amount of revenue generated from CDG operations isn't known, and there's no way of ever knowing. Multiple states had revoked their commercial fundraising license, and sued CDG for penalties due to CDG not filing yearly fundraising reports with the states. Where did all that money go? In reviewing the California filings by CDG for 2007-2009, a total of $19,649,831 where reported raised by CDG. Of that total amount, $1,891,133 where distributed to charities, with CDG retaining $17,758,698 of it. One red flag that comes up with CDG's itemized expense for the fundraising campaigns is the "Fulfillment & Processing Fee", to express that as an acronym, one could use "FPS". Sounds very similiar to the acronym the FTC used for Financial Processing Services, which CDG's Presidents mom was the person behind, and handled all the donation payment disbursements. The total Fulfillment & Processing Fee expense was $3,790,846, almost twice the amount paid to the charities.

From the FTC press release regarding the $18M settlement, and again neither David Keezer or Scott Pasch admit to an wrong doing in this case. Both had amassed substantial assets during the CDG operation, which where forfeited as part of the agreement.

“This scheme packed a one-two punch: it deceived the people who donated, and it siphoned much-needed funds from police, firefighters, and veterans groups,” said David Vladeck, Director of the FTC’s Bureau of Consumer Protection."

Referring back to Brian and Millenium Teleservices, in the final judgement against his brother Scott. The court stated:

"Defendant waives all claims to, unconditionally releases, and consents to the transfer to the Liquidator by the following corporate entities of possession and legal and equitable title of all their respective assets: Civic Development, LLC; CDG Management, LLC; Millennium Teleservices, LLC; Fundraising Processing Center, LLC; National Fundraising Consultants, LLC; National Pharmacy Discounts, LLC; MTSC Management, Inc.; Millennium Teleservices Canada Company; and SPDK, LLC (together, the "Corporations"). Defendant further assigns to the United States all rights, title, and interest in any claims he has against any of the Corporations and in the membership interest in or capital stock oBhe Corporations directly or indirectly owned by him."

"Defendants Pasch and Keezer are required to turn over numerous assets to a court-appointed liquidator. Pasch will turn over a $2 million home; paintings by Picasso and Van Gogh valued collectively at $1.4 million; a guitar collection valued at $800,000; $270,000 in proceeds from a recently sold wine collection; jewelry valued at $117,000; three Mercedes, a Bentley, and various other assets. Keezer will turn over a $2 million home, a Range Rover, a Cadillac Escalade, and a Bentley, among other assets." - https://www.ftc.gov/news-events/press-releases/2010/03/new-jersey-based-telephone-fundraisers-banned-soliciting

Lets take a look at those houses that where forfeited:

|

| David Keezers 10k Sq Ft Home |

|

| Scott Pasch, Brian's Brothers Previous Home |

Not to be left out, and to help answer this posts question. Let's look at Brian's house from 2000-2007, and again, he's not mentioned in the FTC filing, and sold the home in 2007 for $3.7M. Ironically the same year the FTC filed their complaint against CDG.

|

| Brian's Previous home 2000-2007 |

|

| Yes, that is an elevator |

|

| Brian's Wine Cellar in his previous home |